Here’s a statistic we couldn’t help digging into a little deeper- almost twice as many single women are becoming homeowners vs single men. According to data from the National Association of Realtors (NAR), 19% of all homebuyers are single women, while only 10% are single men. And the number of single female homeowners is growing, and for good reasons.

Women Buy Homes for Different Purposes Than Men

Buying a home isn’t just about having a place to live—it’s also a smart way to invest for the future. Homes usually increase in value over time, so they’re a great way to build equity and overall net worth. Ksenia Potapov, Economist at First American, says:

“. . . single women are increasingly pursuing homeownership and reaping its wealth creation benefits.”

The financial security and independence homeownership provides can be life-changing. And when you factor in the personal motivations behind buying a home, that impact becomes even clearer.

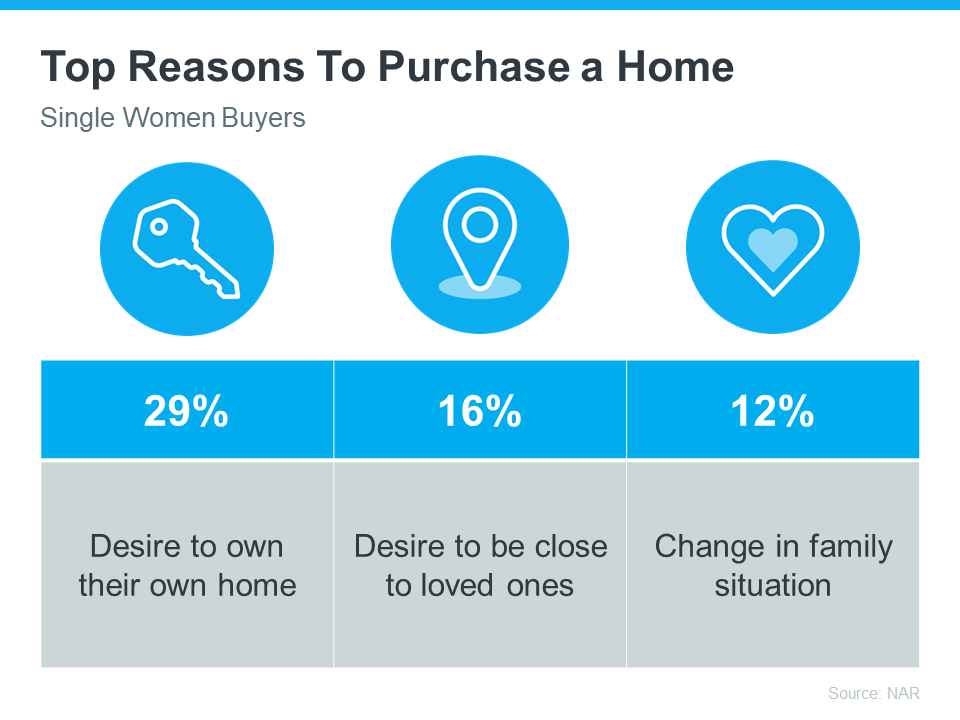

The same report from NAR shares the top reasons single women are buying a home right now, and the reality is, they’re not all financial (see chart below):

Single men’s top reasons to buy a home? Financial stability, establishing roots and attracting potential partners.

Single men’s top reasons to buy a home? Financial stability, establishing roots and attracting potential partners.

Whatever a women’s reason to buy a home is, it is a transaction one wants to be well prepared for.

Women’s Home Equity is Still Behind

Even though single women are buying more homes, wealth accumulation achieved through home equity lags behind that of single men, according to a Yale School of Management study, “The Gender Gap in Housing Returns.” Women pay more to buy a home, and reap less when they sell it. They can afford a smaller chunk of the homes on the market and the homes they do purchase tend to be worth less, making their ownership stake less valuable, other studies show.

However, women can take control, put themselves in a better negotiating position, get favorable loan rates and make a better investment, with some home homework far in advance of viewing prospective houses for sale.

Establishing and improving credit is one important step. Women can also take advantage of free mortgage education programs offered across the country- some even tied to purchasing help, like Minnesota down payment assistance programs.

Work with a Trusted Real Estate Agent

If you’re a single woman looking to buy a home, it is possible, even in today’s housing market. You’ll just want to be sure you have a great real estate agent by your side.

Karen would be happy to listen about what your goals are and why homeownership is important to you, and share her experience about the buying process and regional market. That way we can keep what’s critical for you up front as you move through the buying process. It’s important for your financial future to not only find the right home for your needs, but also to have an experienced negotiator to advocate for you. Together, we can make your dream of homeownership a reality.

Let’s connect to talk about your goals in today’s housing market! Contact Karen directly at info@homesandlakeshore.com to get started.